Introduction

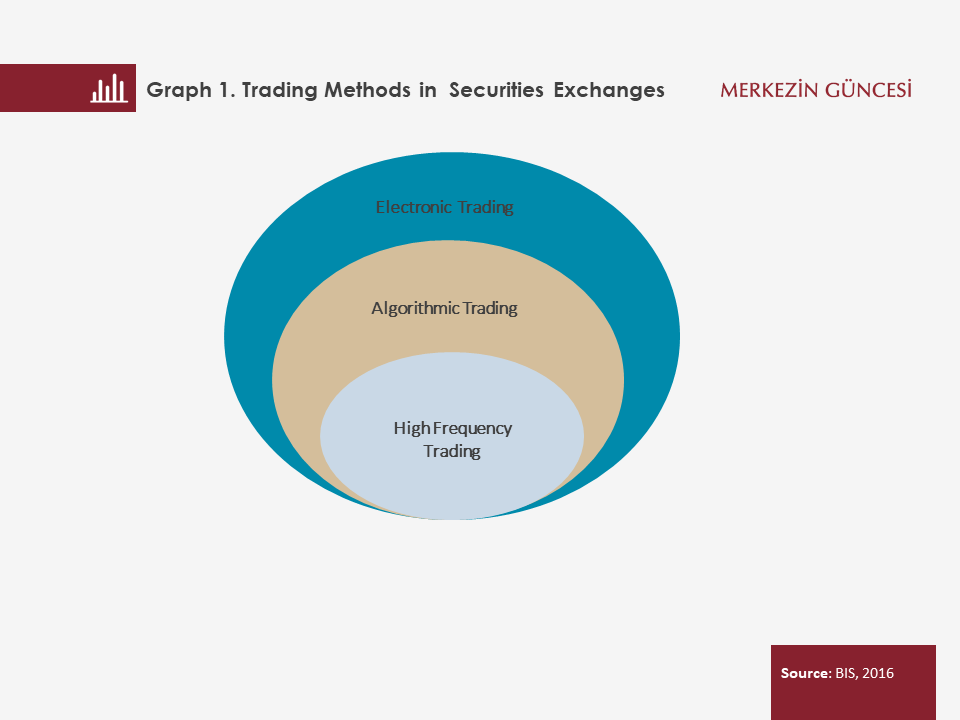

High Frequency Trading (HFT), which is a sub-set of algorithmic trading, is defined as automated buying and selling of stocks by using computers programmed to follow a defined set of investment instructions executed in milliseconds (BIS, 2016). The HFTs, which work on high-tech-connected infrastructures, are used in stock markets, foreign exchange and futures markets through organized exchanges and electronic trading platforms (Graph 1).

As algorithmic trading and HFTs proliferated in these markets, it became necessary to measure the volume of these transactions, detect their impact on price movements and introduce regulations governing these transactions when necessary. HFTs are mostly used in advanced markets and different methods are used to detect HFT-oriented trade transactions. According to findings of various academic studies, HFTs account for 60 percent and 40 percent of total trade volumes in the capital markets of the USA and Europe, respectively[1].

HFTs generate profits mainly in two ways. The first is profiting from minor price differences by carrying out short-term trades at high volumes. Thus, the price differences of a stock traded on more than one market is detected or high-frequency traders make use of the latency arbitrage for the data disclosed for stocks traded on a single market. The second source that HFTs use to make profits is the liquidity provision function. High frequency traders make profits by constantly giving two-way quotations and make profit from the bid-ask spreads and have cost advantage thanks to the market-making function.

Impact of HFTs on Markets

While HFTs contribute to the markets positively by increasing trade volumes, augmenting liquidity and narrowing the ask-bid spreads due to their activities focusing on search for yields, they also entail some risks. Under normal market conditions, HFTs are said to reduce volatility in the market and decrease transaction costs[2] ; nevertheless, in markets experiencing price falls, they are accused of creating selling pressure by a high number of order cancellations, causing a sudden drop in liquidity and market depth, and fueling fluctuations in the markets[3]. Examples of such rapid market fluctuations are the “Flash Crash” of 6 May 2010 in the S&P 500 and the plunge in the British pound on 7 October 2016 [4]. Moreover, HFTs were once more in the spotlight after the 15 October 2014 Flash Crash on US Treasuries when the highest bid-ask spread and the highest trade volume was experienced since the global financial crisis, and the liquidity conditions rapidly deteriorated. The contraction in market liquidity is believed to have stemmed from the decrease in HFT share in the “central limit order book” taken as a reference in measuring market depth[5]. The duplicative trade activities of HFTs make market liquidity look larger than it actually is [6].

Regulatory Approaches for HFTs

Advanced Economies

In advanced economies, there are different approaches towards regulation of algorithmic and high-frequency trading. In the USA, the Regulation Automated Trading (known as the RegAT) is a proposed regulation that seeks to inspect algorithm source codes used by market participants. In the European Union, the MiFID II directive (Markets in Financial Instruments Directive) that took effect in 2018 also allowed inspection of financial institutions carrying out algorithmic transactions and the market infrastructures in which these transactions take place. The Directive stipulates that the data on HFT transactions shall be reported to the local authorities, and the algorithms used shall be logged and tested.

Meanwhile, tighter regulations, increasing competition and market developments point that the competitive power that HFTs enjoy owing to speed advantages is not sustainable. The profit margins have significantly fallen due to high-cost infrastructure investments and the low volatility levels in securities markets of developed economies. In the USA, income from market-making activities in securities markets, which was US$ 7.2 billion in 2009, dropped to US$ 1.1 billion in 2016[7]. This indicates that the income that HFT derive from the market-making function is decreasing.

Emerging Markets

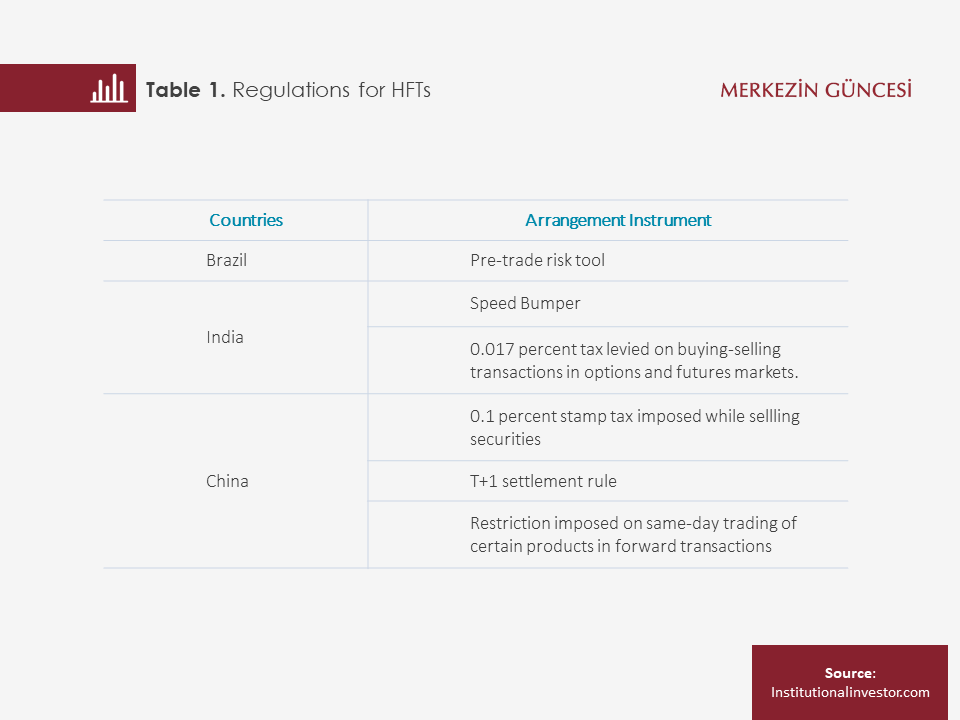

HFTs, which started to be used in capital markets of emerging economies over the last few years, contribute to the increase in trade volumes and market depth. In the Asia region, where China and India are counted in, HFT transactions’ market share in 2015 is estimated to have been 32 percent, approximately. The share of HFT transactions in Russian and Brazilian stock markets is 26 percent and 21 percent, respectively[8]. Nevertheless, it is obvious that building a regulatory infrastructure for HFTs in emerging economies is necessary to curb the potential risks that these transactions can pose to stock markets and their adverse impacts on financial stability. Actually, emerging economies have been introducing some instruments towards regulating HFT transactions (Table 1).

Analysis shows that the share of HFT transactions in total trade volume in Borsa Istanbul can reach as high as 6 percent, and that this ratio is higher in high-amount transactions [9]. The amount of HFT and algorithmic trading is expected to increase if Borsa Istanbul provides collocation services [10] and the stock exchange infrastructure starts supporting HFT transactions [11]. The prospective impact of these transactions on financial markets should be monitored closely.

[1] Jeremy Grant. High-frequency trading: Up against a bandsaw. Financial Times (3 September 2010).

Haldane, A. G. (2010). Patience and finance. Speech to Oxford China business forum. Beijing: Bank of England.

[2] Eichengreen, B., Romain, L. and Arnaud, M. (2017). Thick vs. Thin-Skinned: Technology, News, and Financial Market Reaction. IMF Working Paper, No. 17/91.

[3] Gerig, A. (2012). High-Frequency Trading Synchronizes Prices in Financial Markets. Working Paper, http://ssrn.com/abstract=2173247.

[4] Kirilenko, A., Albert, S. K., Mehrdad, S. and Tugkan, T. (2017). The Flash Crash: High Frequency Trading in an Electronic Market. Journal of Finance, Vol. 72, No: 3, Pages 967–998.

[5] BIS (2016). Electronic trading in fixed income markets.

[6] ESMA (2016). Order duplication and liquidity measurement in EU markets.

[7] Tabb Group, http://tabbforum.com/

[8] Aite Group, http://aitegroup.com/

[9] Between January 2013 and May 2014, 6 percent of the total trade volume in Borsa Istanbul was composed of HFT transactions. The share of HFTs in high-amount transactions was 11.96 percent. Another study, which uses a different calculation method, shows that between January 2015 and November 2015, 1.23 percent of the total trade volume of 422 stocks in Borsa Istanbul were HFT transactions.

Ekinci, C. And Ersan, O. (2016). Algorithmic and high-frequency trading in Borsa Istanbul. Borsa Istanbul Review, Vol. 16, No. 4, Pages 233-248. Ekinci, C. and Ersan, O. (2017). A new approach for detecting high-frequency trading from order and trade data. Finance Research Letters,

[10] When co-location service is available, market participants maintain their systems in the same location as the exchange’s market systems allowing them to have direct access to the stock market quickly and safely.

[11] http://www.borsaistanbul.com/en/frequently-asked-qestions-faq/faq-about-it