“The currency in circulation”, which is defined as the total amount of banknotes put into circulation by the central bank of a particular country, is basically determined by public as well as banks’ cash demand. Currency in circulation is affected by economic variables such as monetary policy implications, inflation and interest rates, exchange rates, income level of households as well as developments in alternative payment instruments such as credit cards, cheques and online banking. Besides these variables, other factors like households’ payment habits, willingness to conceal banking transactions or the practicality of using cash for small payments also affect the amount of banknotes in circulation.

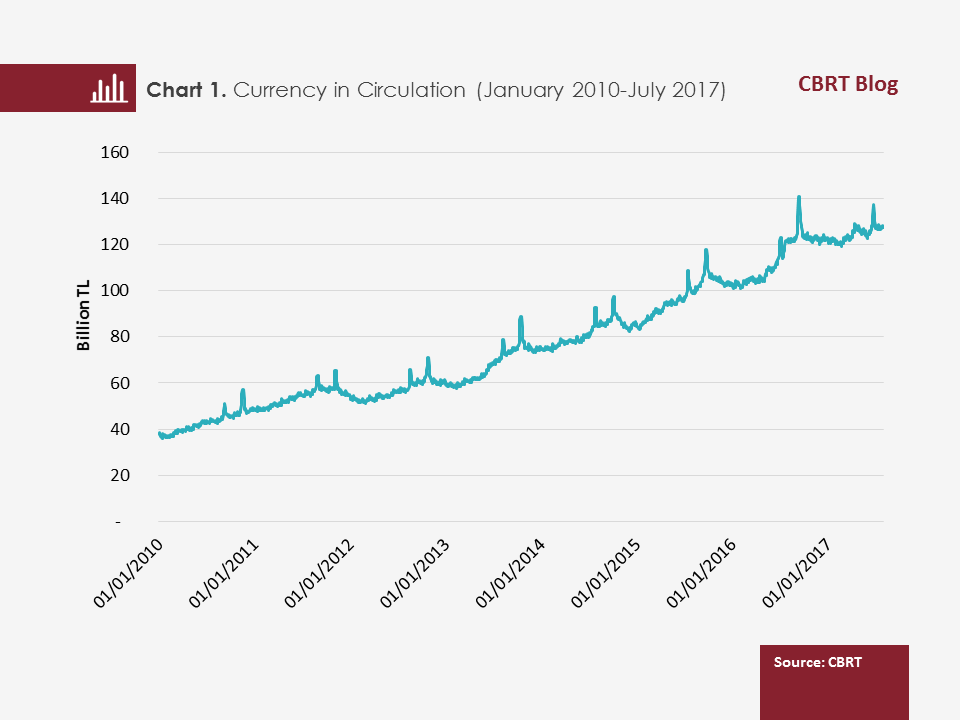

Chart 1 shows the trend of currency in circulation in Turkey over recent years. The amount of currency in circulation, which was TL 38 billion in early-2010, more than tripled and exceeded TL 127 billion by the end of July 2017.

Besides the impacts of these mentioned variables on households’ cash demand, the currency in circulation is also affected by seasonal movements as well as calendar and working day effects. In this blog post, we tried to determine the seasonal, working day and calendar effects on the real amount of currency in circulation since September 1989. We estimated the monthly, daily and weekly impacts on growth of currency in circulation via dummy variables. Moreover, we controlled pre and post-religious holiday periods to examine the calendar day effect on growth of currency in circulation[1].

Seasonal Effects

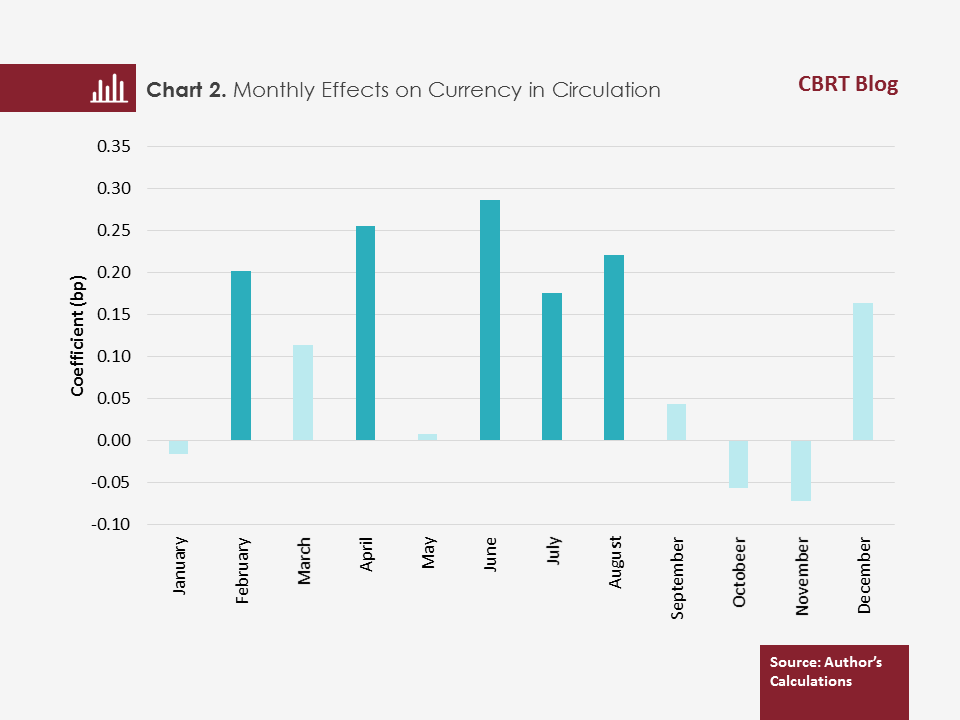

Chart 2 shows estimated coefficients of monthly effects on the growth of currency in circulation[2]. It has been observed that February, April, June, July and August make significant contributions to growth of currency in circulation. In summer, growth of currency in circulation rises primarily because of the holiday spending of households. The significant and positive contribution of February to growth of currency in circulation is attributed to the semester break.

Days of the Week

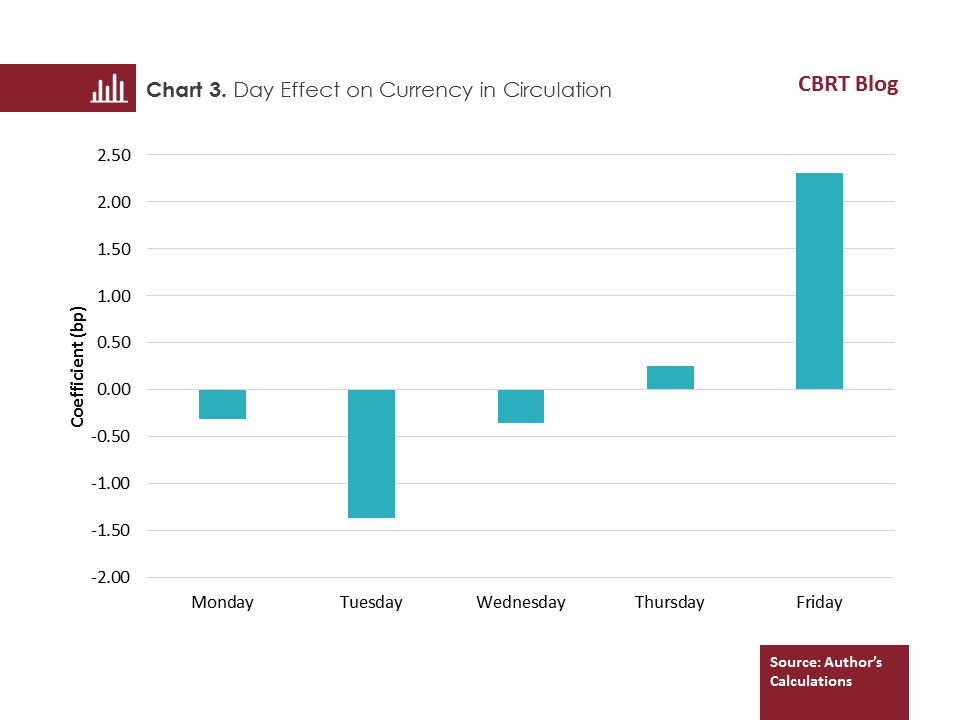

Basically, due to effects stemming from households’ increased spending needs at the weekends and banks’ loading of money into ATMs to meet the cash demand, a rise is expected in the currency in circulation particularly on Fridays followed by a decrease on the first days of the week. Therefore, we tried to detect the day effects on the currency in circulation and presented estimated coefficients in Chart 3. All coefficients are significant and this points to the fact that growth of currency in circulation systematically varies according to individual days of the week. The Friday effect in particular makes a 2.5 bp contribution to growth of currency in circulation, while the Tuesday effect leads to a 1.5 bp fall in growth of currency in circulation.

Wage Payments

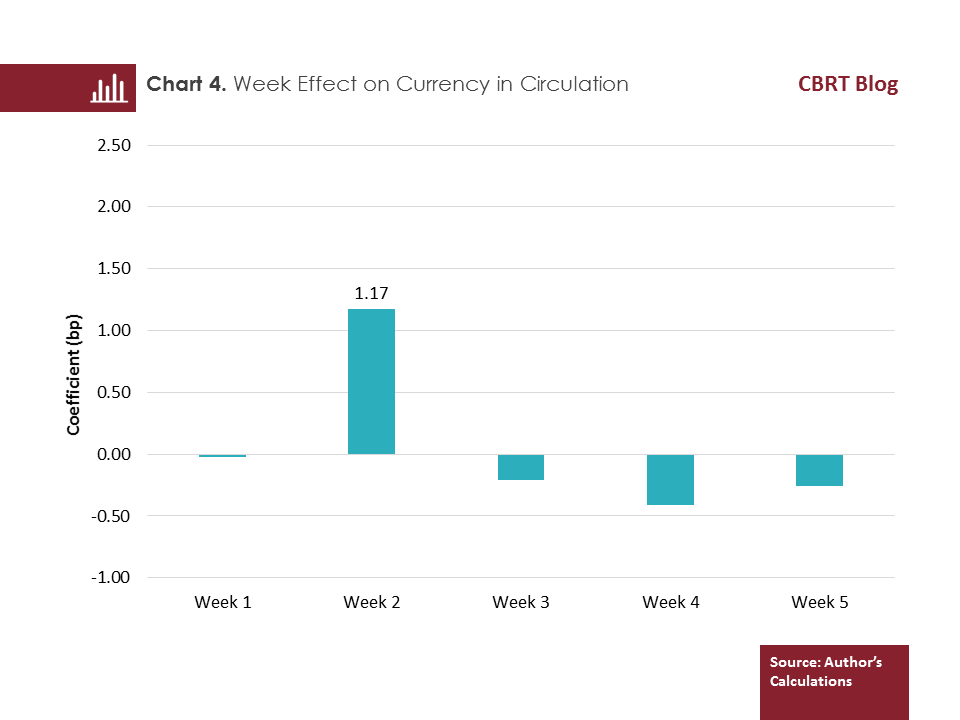

Wages are mostly paid either at the beginning of each month or around the 15th of each month. We observed that wages paid in the middle of the month induce significant changes in the currency in circulation. To show seasonal effects more clearly, all months from 1989 to July 2017 have been aggregated based on weeks and analyzed.[3] As shown in Chart 4, the change in the second week of each month coverings wage payments made on the 15th of each month, is quite remarkable. The week of wage payments contributes to the growth of currency in circulation by 1.1bp

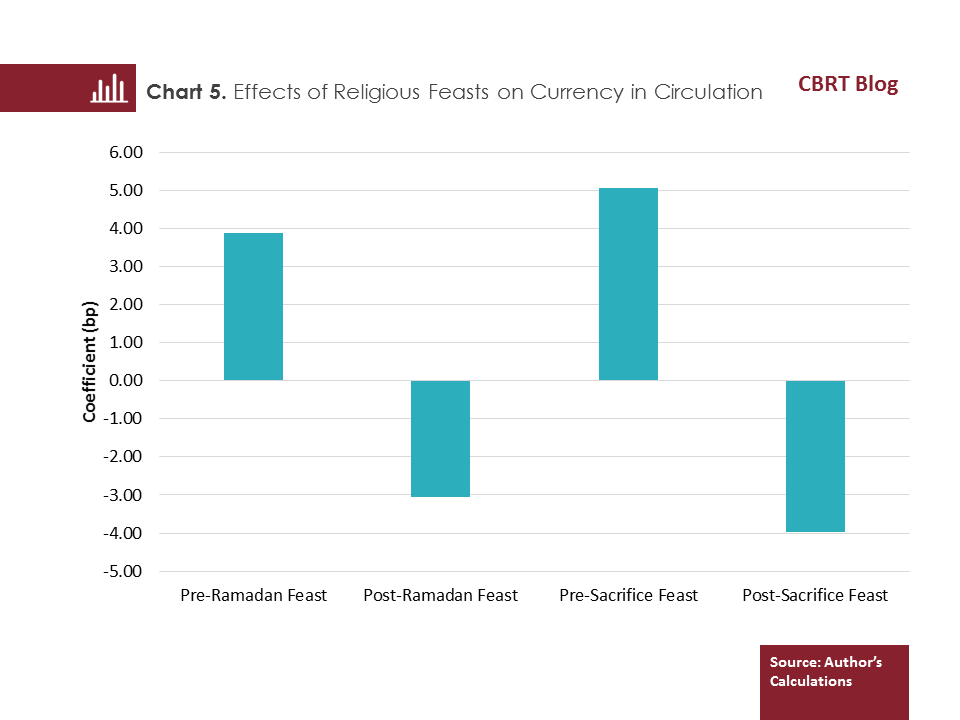

Religious Feasts

It is important to detect the calendar effect on the currency in circulation because economic activity is really robust during official holidays in Turkey. Households’ cash demand significantly increases during religious feasts which in turn increases banks’ cash demand to meet their customers’ demand. Chart 5 shows estimated coefficients for the pre- and post-holiday periods[4]. The remarkable rise in households’ cash demand before feasts makes a significant contribution to the growth of currency in circulation. While the contribution of the Feast of Ramadan (Eid al-fitr) to growth of currency in circulation is approximately 4 bp, that of the Feast of Sacrifice (Eid al-adha) is 5 bp. Currency in circulation, which rises before the religious holidays, reverts to the initial levels after the holiday. The rise in currency in circulation during the Feast of Sacrifice (Eid al-adha) is more manifest as this feast is longer than the Ramadan holiday and there is an intense cash demand for sacrificial livestock.

In sum, the findings of our analyses suggest that seasons, days, feasts and wage payment periods cause significant fluctuations in the growth of currency in circulation. While households’ and banks’ cash demand may vary according to variables such as income level and inflation rates in addition to developments in the utilization of alternative payment instruments; it should also be taken into account that seasonal, daily and calendar effects could influence the cash demand periodically.

[1] In this framework, the equation: has been estimated. Three days before and after the feast have been taken into account.

[2] The effects in dark blue are econometrically significant.

[3] Weeks in dark blue denote that the effects in that week are econometrically significant. The effects in the first week of each month are minimal and econometrically insignificant.

[4] Effects marked dark blue are econometrically significant.

References:

Atabek, A. (2014), Seasonal Anomalies in Foreign Trade Statistics (available only in Turkish), CBRT Research Notes in Economics, No: 2014/07.

Çulha, O. and Eren, O. (2016), Day Effect on Foreign Trade Statistics (available only in Turkish), CBRT Research Notes in Economics, No: 2016/10.