The financial strength of the corporate sector is essential for supporting and sustaining economic activity and financial stability. Therefore, access to sound and reliable data gained more importance in the aftermath of the global financial crisis and studies on data gap including the corporate sector intensified across the world.

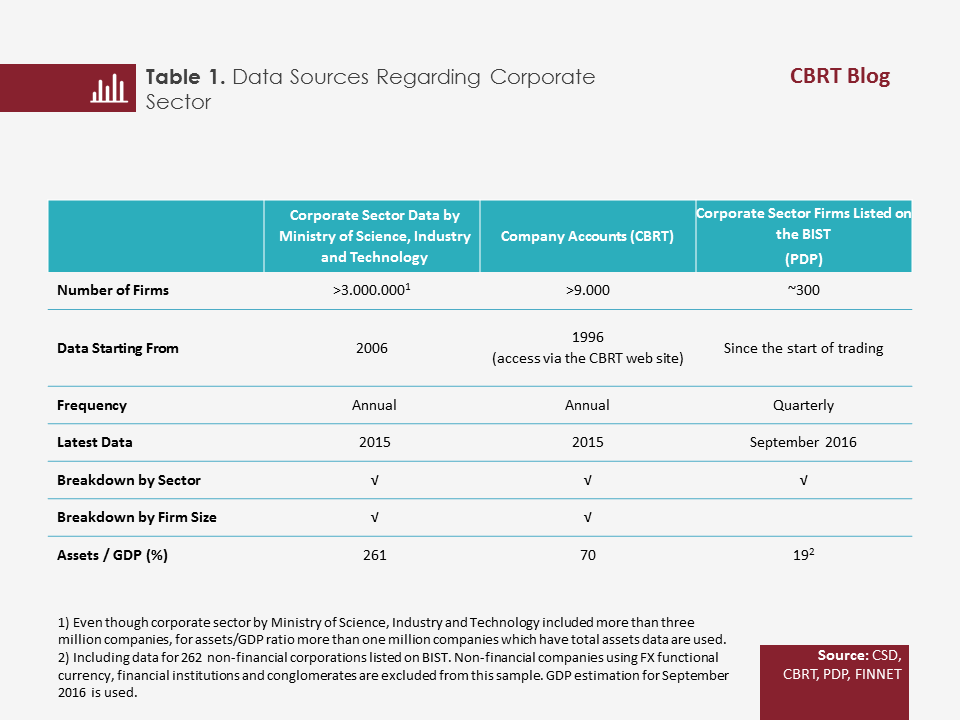

Corporate Sector Database (CSD) provided by the Ministry of Industry, including approximately three million firms, and the CBRT Company Accounts, including data on more than nine thousand firms, are the main data sources regarding corporate sector firms in Turkey. These data are published annually on a sectoral basis and with a breakdown by firm size. On the other hand, it is possible to reach high frequency and more up-to-date data of companies listed on Borsa İstanbul (BIST) via independent audit reports that are publicly available. Data regarding firms’ consolidated foreign exchange assets and liabilities along with external financial debts are published monthly by the CBRT. For international comparisons, statistics of institutions such as the BIS and the IMF are used in general.

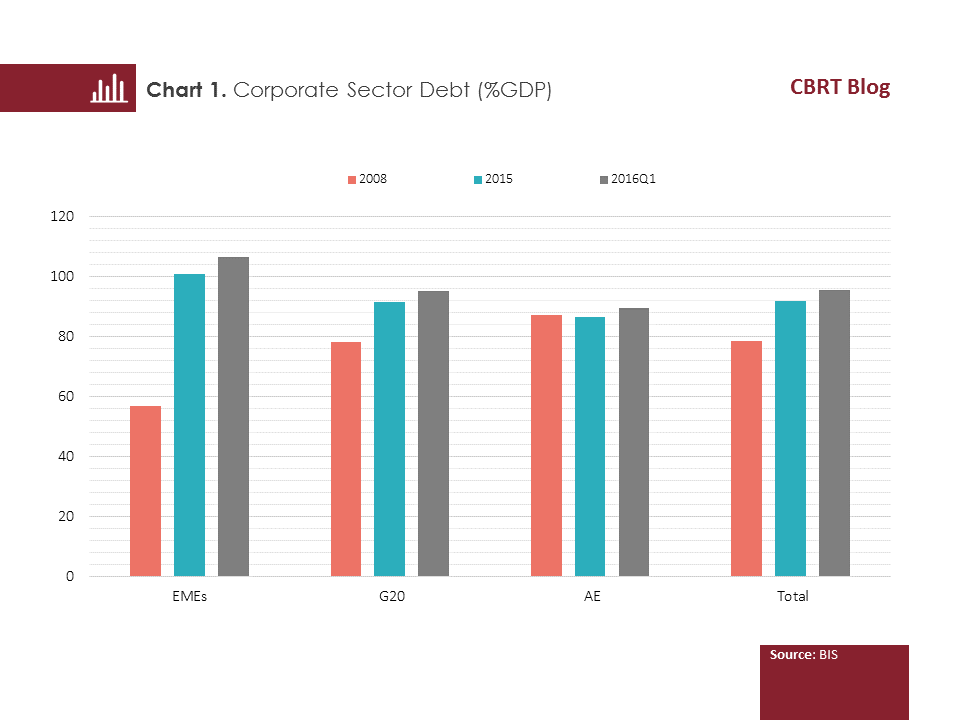

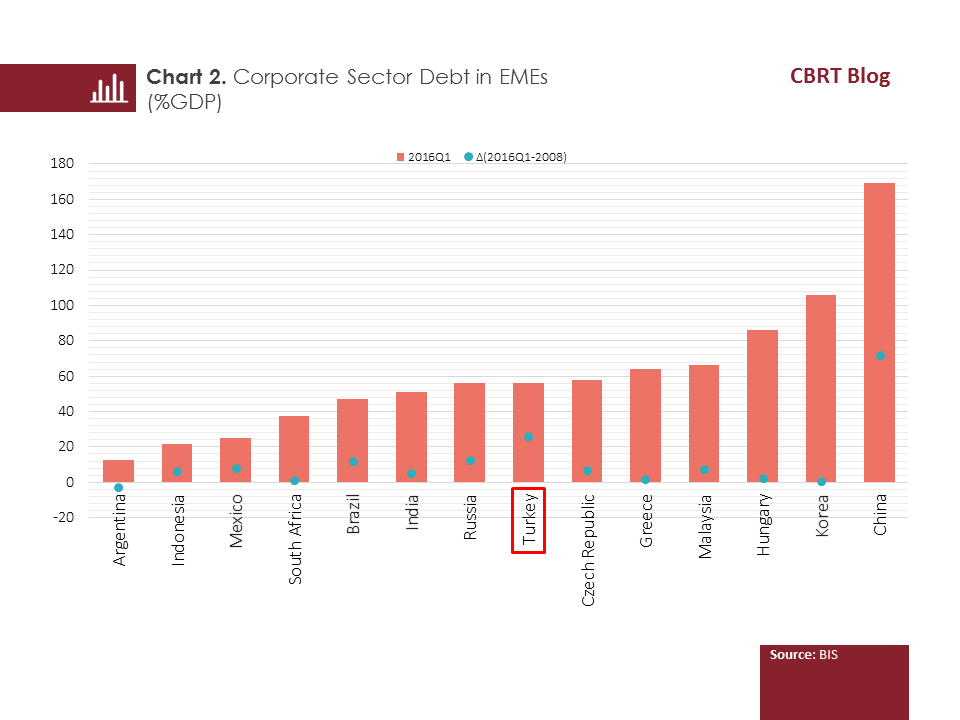

Due to expansionary monetary policies of advanced economies following the global financial crisis in 2008, the global liquidity has progressively channeled towards emerging market economies (EMEs). Thus, these economies gained a favorable environment in terms of access to finance and the financial debts of the corporate sector increased significantly compared to GDP. In Turkey, although the ratio of total corporate debt to GDP has increased compared to 2008, the current ratio is close to peer country averages. A close monitoring of the developments in the corporate sector’s debt structure is essential for both the continuity of economic activity and the development of credit risk exposure of the financial sector.

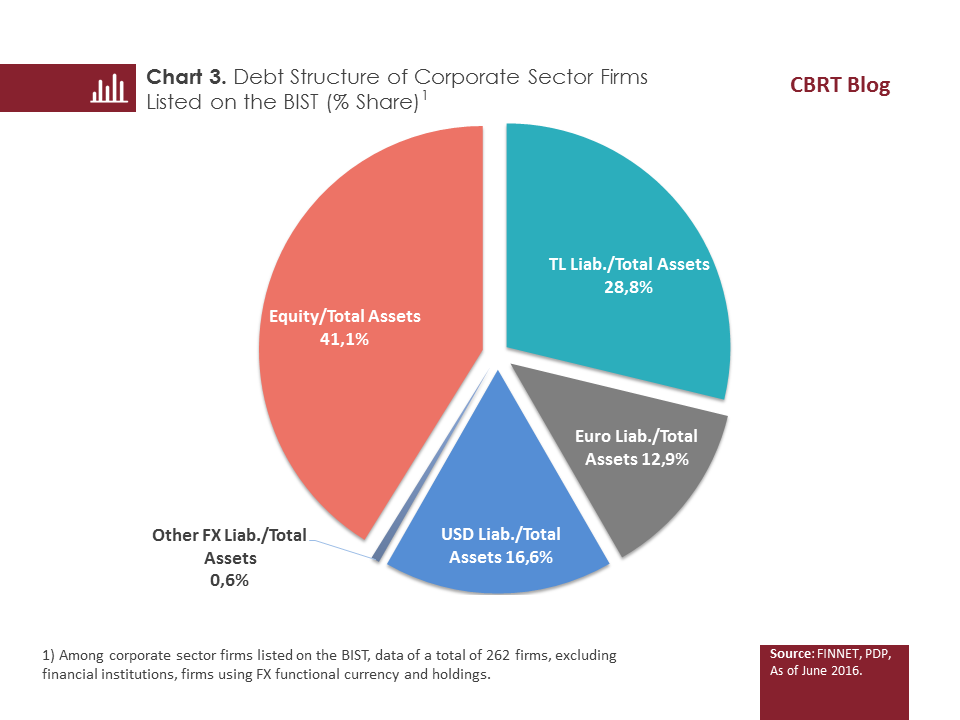

The corporate sector’s strong equity capital against financial debts on balance sheet is considered the main determinant of its resilience to possible internal and external financial fluctuations. The sample on the BIST-listed corporate sector firms shows that their equity makes up more than forty percent of assets, which is a favorable indicator in terms of possible exchange rate risk coverage.

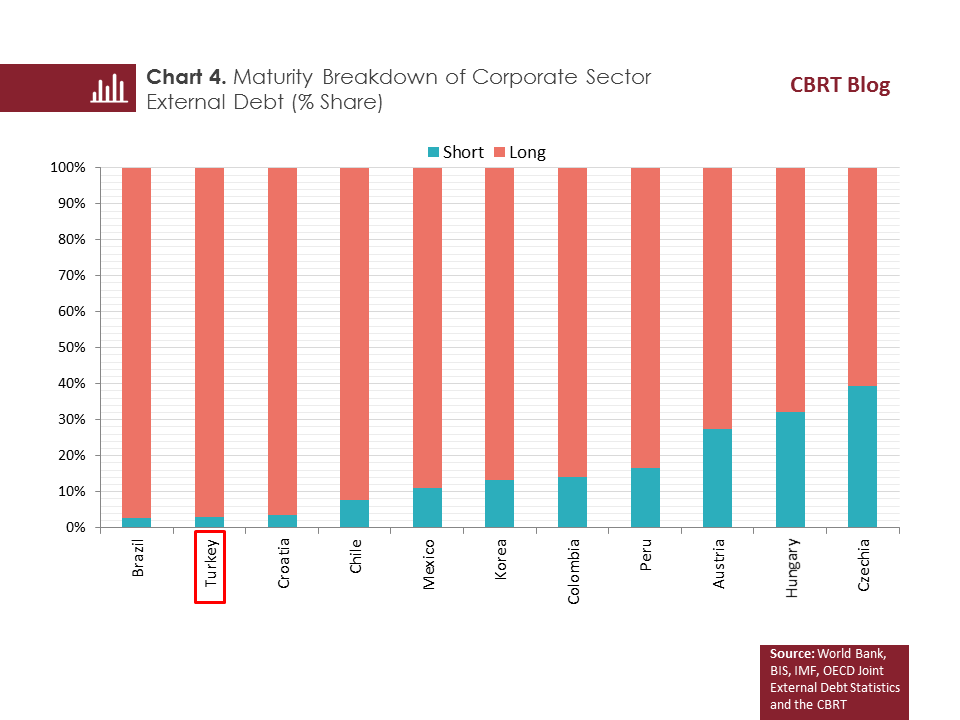

Financial liabilities of the corporate sector in Turkey are predominantly long-term, which limits the likely risks that might stem from interest rate and exchange rate volatilities. The extent to which firms’ financing expenses are covered by their profits, provides an additional hedge for rolling over financial debts. Moreover, the FX debts of the corporate sector are mostly concentrated in large-scale firms, which can be noted as a factor limiting corporate-sector driven risks to financial stability.