In December 2024, the Central Bank of the Republic of Türkiye (CBRT) stated its goal to terminate the FX-protected deposit (KKM) scheme in 2025 in its Monetary Policy Text for the year. The exit from the KKM scheme was targeted to be gradual, accompanying the continuing increase in the share of Turkish lira (TRY) deposits. Accordingly, the opening and renewal of KKM accounts for legal entities was terminated in February. With the announcement on August 23rd, KKM openings and renewals for real persons have also been terminated in line with the aforementioned goal.

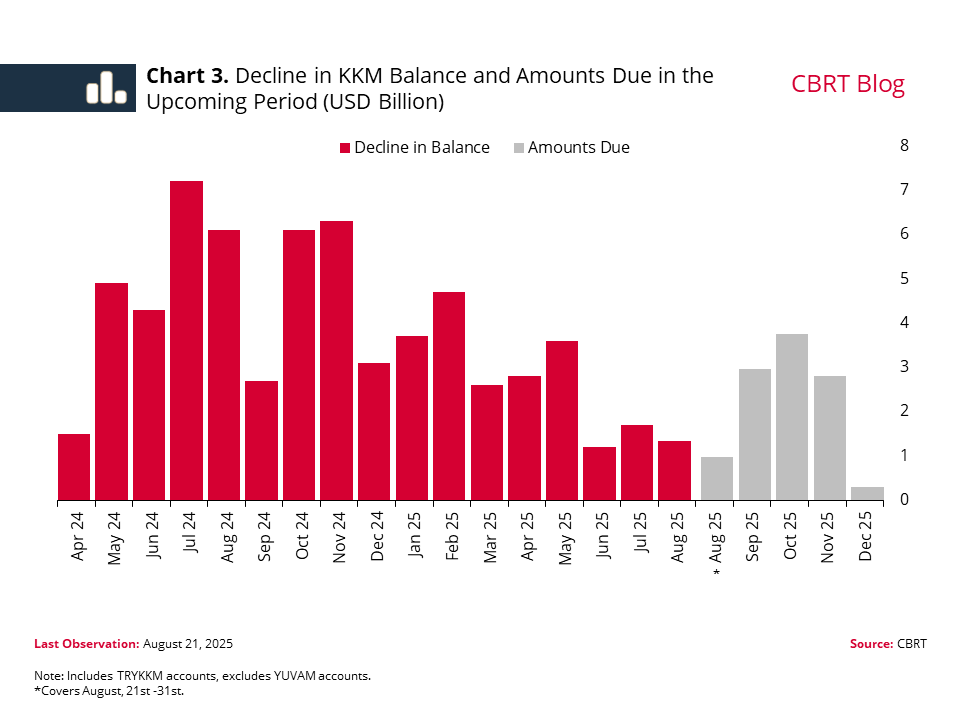

Over the last two years, KKM balance has gradually declined. During this period, macroprudential tools such as targets for renewal and transition to the TRY as well as TRY share targets, reserve requirement (RR) ratios, RR remunerations, and minimum interest rates charged on KKM accounts were actively used. Having exceeded USD 140 billion by mid-2023, the KKM balance declined to USD 11 billion as of August 21, 2025 (Chart 1).

Macroprudential regulations were calibrated taking into account the relative cost dynamics to encourage banks to favor Turkish lira funding over KKM. Specifically, the spread between the RR ratios set in favor of TRY over KKM deposits and the remuneration paid for RRs were used to affect funding costs. In addition, the minimum interest rate applicable to KKM accounts was gradually lowered, and the withholding tax advantage on KKM accounts was terminated.

Under the tight monetary policy stance, these complementary steps supported the attractiveness of TRY deposits and limited the shift towards FX from the KKM accounts. In addition, declining exchange rate volatility, which is a key determinant of depositors' preference for KKM, widened the yield spread between KKM and TRY deposits in favor of TRY. As of August 19, 2025, the KKM share declined to 1.8%, while the TRY deposit share rose above 60% (Chart 2).

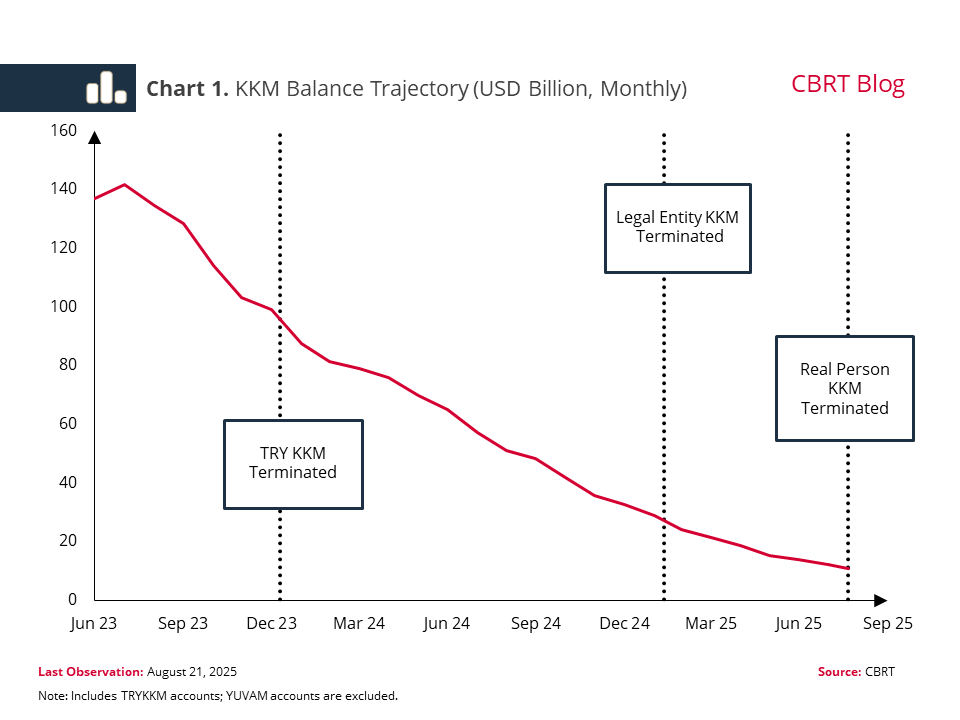

The KKM accounts due in the upcoming period will be close to the balance decline in the previous period. As such, the necessary conditions to discontinue the scheme appear to be in place (Chart 3). Moreover, the decline in the underlying trend of inflation and the attractiveness of the Turkish lira deposits further support the exit from the KKM scheme. The gradual phasing out and eventual termination of the KKM accounts strengthened the pass-through from monetary policy to banks’ funding costs while reducing the risks on the CBRT’s balance sheet.