Firms may demand foreign currency for various reasons, including import payments, financial liabilities, hedging against exchange rate volatility, and investment preferences. Understanding the factors that drive this demand is crucial for financial stability and the effectiveness of monetary policy. This blog post explores the dynamics of the real sector firms' foreign exchange (FX) demand over time and the underlying sources of that demand.

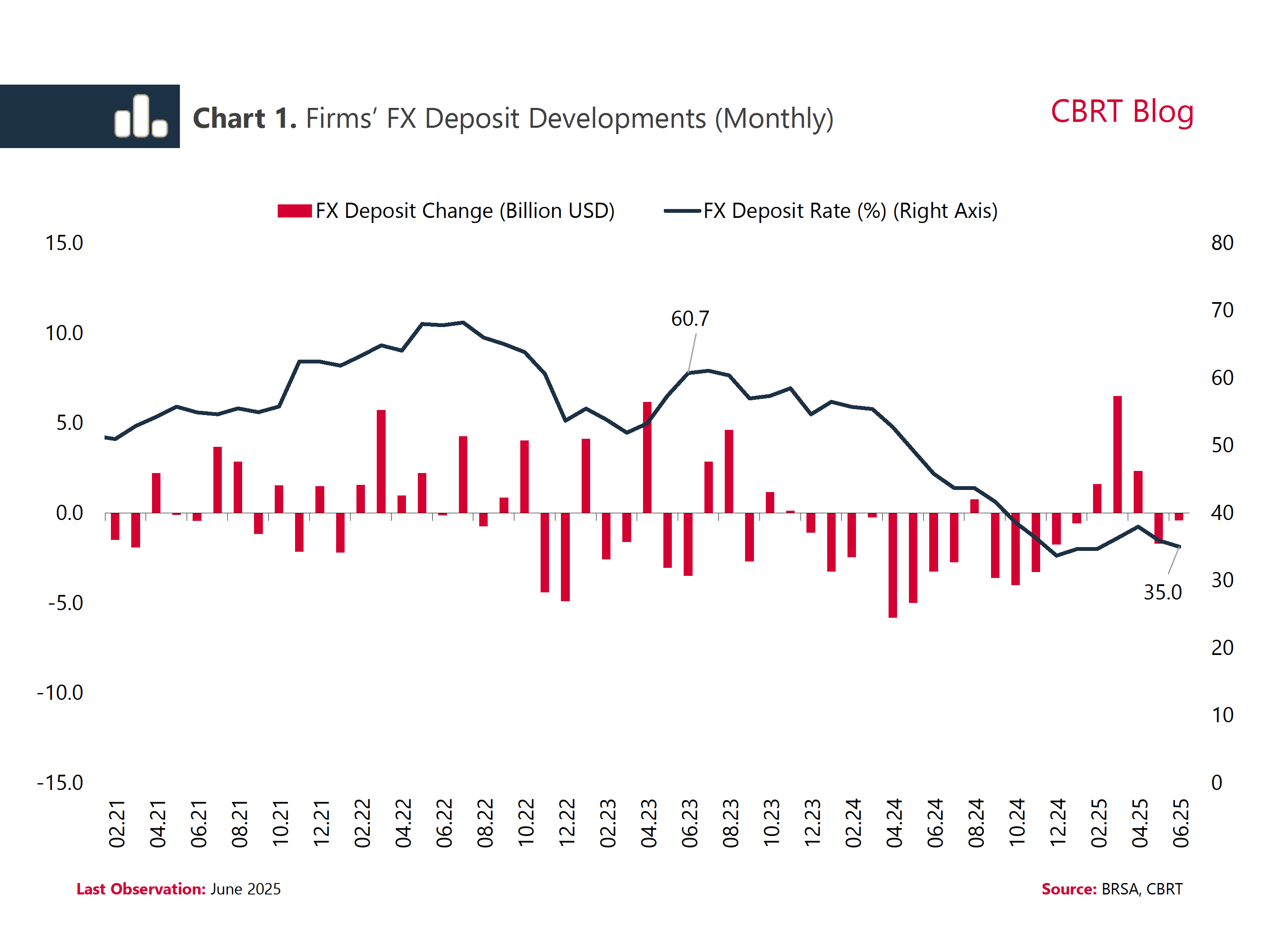

One of the most commonly used indicators of firms' FX demand is the share of FX deposits in total deposits.[1] Along with the monetary tightening, firms' FX deposit ratio dropped from 60.7% in June 2023 to 35% in June 2025 (Chart 1).

While the decline in the share of FX deposits suggests a reduction in firms' tendency to accumulate FX, flow data provide a clearer picture of the slowing FX demand in the real sector. This requires a look into firms' FX transactions in both the spot and forward markets, net FX revenues from foreign trade, and use and repayment of FX loans. Thus, we net out firms' major FX inflows and outflows, and calculate a firm-based FX flow applying the following formula:[2]

A positive FX flow indicates that the firm accumulates FX, while a negative flow reflects a reduction in its existing FX holdings. Accordingly, we analyze the developments in the real sector's FX flows from January 2021 to May 2025.[3] The findings show that firms' tendency to accumulate FX revenues declined significantly after 2023 (Chart 2). A breakdown of FX flows by firm groups reveals that the decline is led by net exporter firms (Chart 3).[4] Despite a rise in exports and FX loan utilization during the monetary tightening period, the fall in FX flows indicate that net exporter firms boosted their FX sales. Meanwhile, the FX flows of net importer firms remained negative and flat over the same period. This suggests that net importer firms' FX needs remained constant.

The trend in FX flows shows that firms' demand for FX has declined over time, and that the real sector has become a net seller of FX over the past year (Chart 4). Although this trend slowed moderately after March, when exchange rate volatility was observed, firms continue to be net sellers of FX. Meanwhile, net importer firms’ share in total FX purchases of the real sector is increasing (Chart 5). This share, which averaged around 57% between January 2021 and May 2023, rose to 65% in tandem with the monetary tightening period. This suggests that firms' import-related needs have played a more significant role in the recent FX demand.

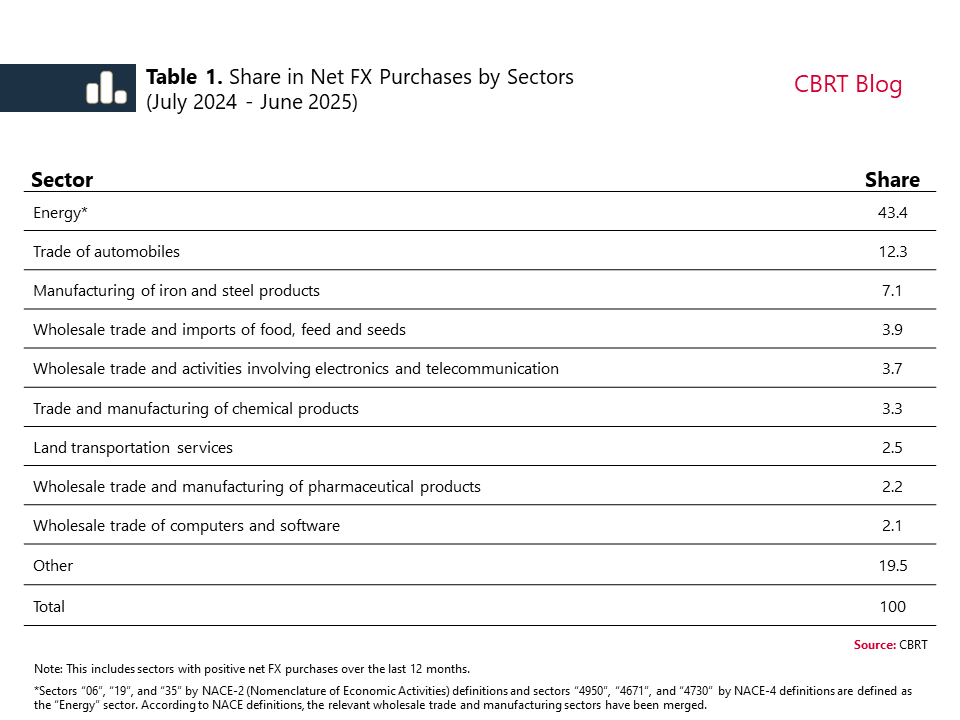

Finally, we examine the breakdown of the real sector's recent net FX demand by sectors. To this end, we focus on sectors with positive net foreign exchange purchases over the last 12 months. We observe that among these sectors, import-oriented sectors led by energy, automobile trade, iron and steel, chemicals, and telecommunications had the highest share in total net FX purchases (Table 1).

To sum up, we observe a clear change in firms' FX accumulation behavior and FX demand during periods of monetary tightening. While net exporter firms supply FX to the financial system, net importer firms demand FX close to the long-term average. The recent FX purchases are mainly driven by net importer firms' foreign trade payments. These developments suggest that net exporter firms' contribution to FX supply continues.

[1] Firms' total FX deposits include their FX deposit accounts, FX-protected deposit accounts converted from FX (DDM), and precious metal deposit accounts.

[2] Firms may experience FX inflows or outflows through channels not discussed in this blog post. We excluded FX transfers abroad for non-import purposes, FX earned from non-export sources, and domestic FX-denominated financial transactions. Export figures cover firms' exports of goods and services.

[3] The calculations in Chart 2 and subsequent charts do not include firms' FX sales with FX-protected accounts converted from FX (DDM).

[4] We define firms with exports higher (lower) than imports between January 2021 and May 2025 as net exporter (importer) firms.