Banks’ balance sheets are predominantly composed of loans with low liquidity. On the other hand, banks can face unforeseen liquidity risks arising from factors such as cash withdrawals, tax payments and payment system movements, all of which lead to a change in their short-term liquidity needs. The CBRT, as the lender of last resort, provides the system with short-term liquidity facilities against collateral to secure uninterrupted functioning of payment systems and to enable banks to fulfill their obligations in time.

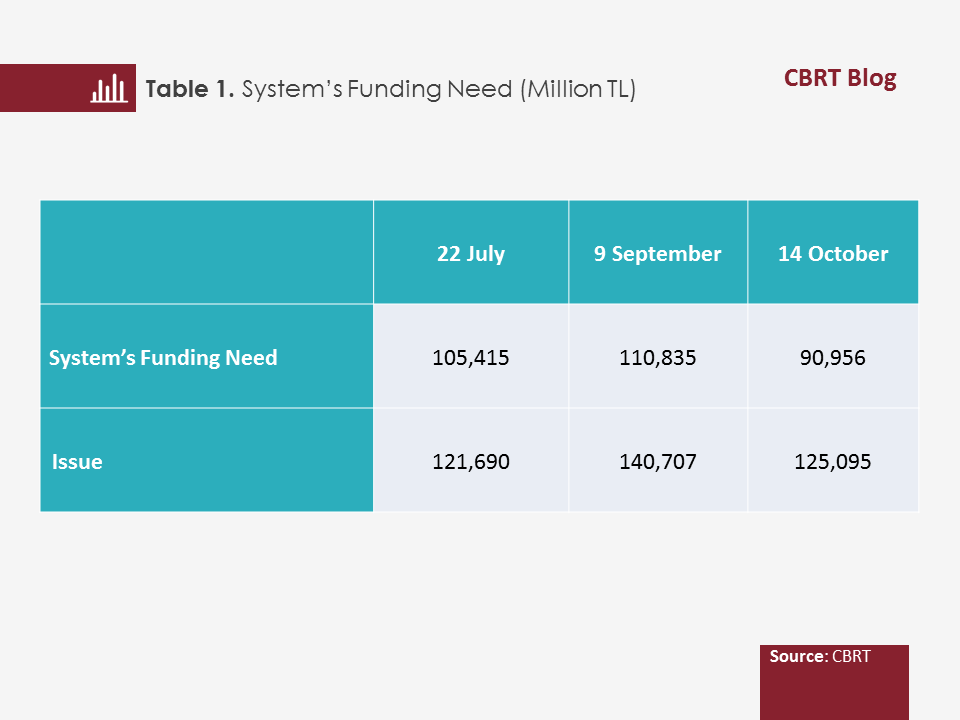

The banking system’s funding need (SFN) is determined by:

- Changes in monetary base,

- TL transactions of the CBRT with the market,

- TL transactions of the Treasury with the market

Developments in the monetary base and the TL transactions of the CBRT with the market have become the main determinants of the level of the SFN in the recent period.

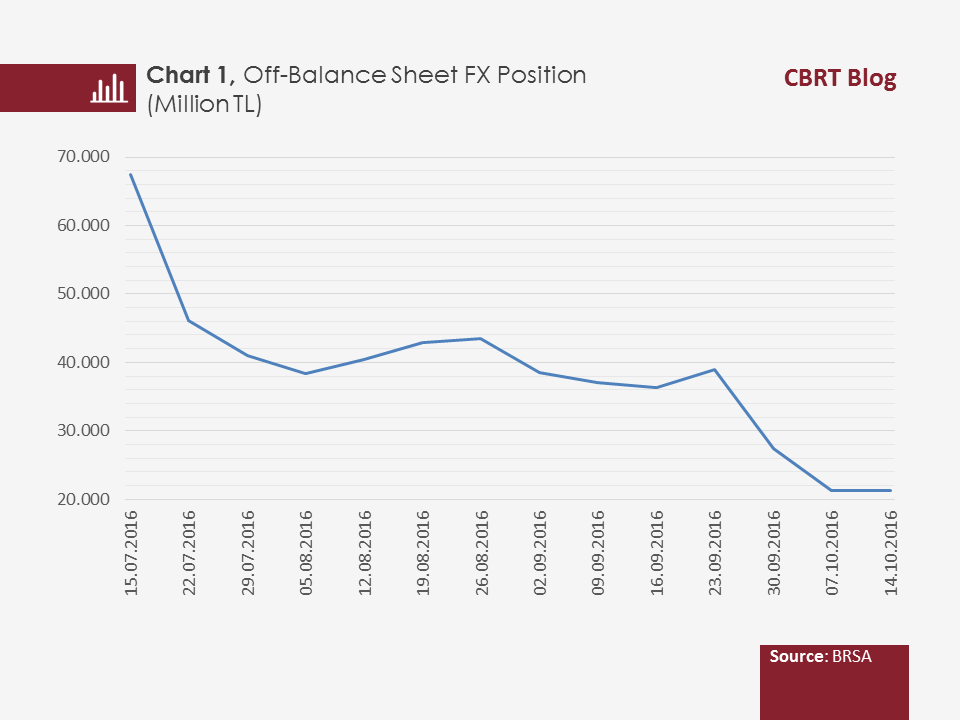

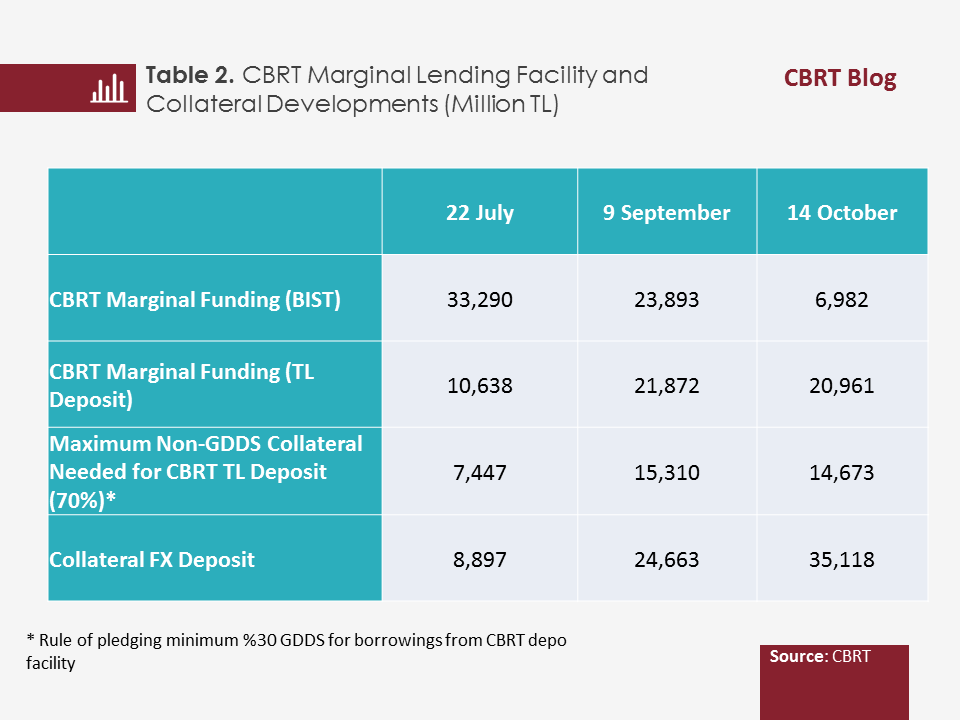

In the aftermath of the domestic developments in mid-July, the CBRT took action to ensure efficient functioning of financial markets and announced its package of measures consisting of seven items on 17 July 2016. In this context, banks were allowed to place foreign exchange deposit as collateral without limits in the case of a need, to boost support the Turkish lira liquidity management of financial institutions. The flexibility of collateral management offered to banks with the provision of limitless collateral FX deposit facility allowed them to conduct short-term exchange rate swap transactions through the CBRT, which incurred rising interest rates due to the financial distress, and hence duly contributed to the liquidity management of banks. In addition, the limitless collateral FX deposit facility also supported the decrease in the off-balance sheet foreign exchange position due to the effect of reducing the currency mismatch between banks’ assets and liabilities.

Although the SFN had gradually decreased since the beginning of September 2016, the Turkish lira deposit transactions remained flat. In the same period, banks, out of the collaterals they used for their overnight TL liquidity transactions from the marginal funding rate at the Borsa İstanbul (BIST) Debt Securities, Repo/Reverse Repo Market, preferred to release Government Domestic Debt Securities (GDDS) and held ready-to-use collateral FX deposits at the CBRT. This led to a change in the composition of the assets held by banks as collateral for their Turkish lira transactions at the CBRT thanks to the limitless collateral FX deposit facility. Due to the collateral flexibility offered, banks shifted a portion of their borrowings from the BIST Debt Securities, Repo/Reverse Repo Market to the Turkish lira deposit transactions at the CBRT.

Despite the decreasing funding need of the system and the flat course of the CBRT Turkish lira deposit transactions, banks opt to hold collateral FX deposits at the CBRT that are not subject to Turkish lira transactions. This is no different than the banks’ holding of GDDS at the CBRT that are not subject to Turkish lira transactions. It is a common practice for banks to hold unencumbered collaterals at the CBRT, which is the lender of the last resort, for liquidity management purposes, which has no determining effect on the level of Turkish lira liquidity.